AUGUST REAL ESTATE UPDATE

- Michael Harris

- Aug 12, 2025

- 3 min read

Missed spring volume. Continued buyer uncertainty. Increased investor influence.

It’s been a while since we last discussed the housing market, as our recent conversations at BlackFin have focused more on process improvement. However, given the number of developments over the past six months, I thought it would be a good time to revisit the state of the housing market.

The U.S. housing market has experienced an unusually slow spring, with home sales falling to their lowest levels for the season in over a decade. Existing home sales in May were the slowest since 2009, despite a slight month-over-month increase. Buyer activity remains limited due to affordability challenges, high mortgage rates, and economic uncertainty. Median home prices have surged 52% since May 2019, while wage growth has lagged behind at 30%. The result is a doubling of typical monthly mortgage payments—from around $1,000 pre-COVID to over $2,000 today—making homeownership increasingly unattainable for first-time buyers.

Economic uncertainty is compounding these challenges. While inflation has eased to 2.7% year-over-year as of June, it remains above the Federal Reserve's 2% target. The Fed has signaled potential rate cuts later this year, but those reductions may not directly translate to lower mortgage rates. In the meantime, the broader economy is marked by historically high credit card debt, low savings rates, and uneven job market confidence. These dynamics have contributed to rising buyer hesitation and the highest home purchase cancellation rate (14.9%) since 2017.

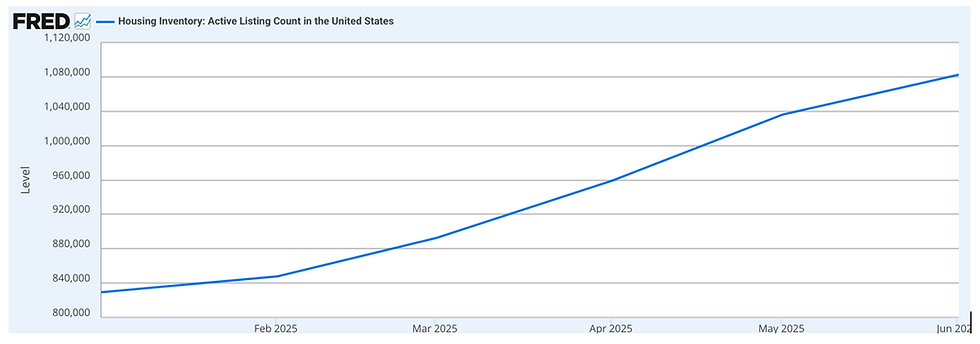

Inventory levels have improved significantly, with active listings up 20% year over year, particularly in the West and South. However, the increased supply hasn’t yet translated into stronger buyer demand. There are now an estimated 34% more sellers than buyers in the market, and the condo segment is especially imbalanced, with 83% more condo sellers than buyers. Despite this, prices continue to climb modestly, with the national median single-family home price in May reaching $427,800, a 1.3% increase from the prior year. The persistence of high prices despite sluggish sales reflects an underlying imbalance in market fundamentals.

A growing contributor to this distortion is investor activity. Nearly one in three single-family homes sold this year went to investors—ranging from large institutions to smaller cash buyers and syndicates. These buyers, often able to waive contingencies and close quickly, are increasingly favored by sellers over traditional homebuyers. Builders, facing weak demand from individuals, are also offloading inventory to investors. This shift is artificially supporting home prices and crowding out working families, turning entry-level housing into a competitive asset class rather than accessible shelter.

The result is a housing market that isn’t functioning normally. Prices remain high not because of end-user demand, but because capital markets view real estate as a high-yield investment. With transaction volumes down and affordability worse than during the subprime crisis, first-time and working-class buyers are being priced out. Unless mortgage rates fall substantially or investor appetite wanes, ownership will remain out of reach for many, and the housing market will continue to reflect speculative pressures rather than fundamental housing needs.

In conclusion, several key developments—such as rising inventory levels and signs of price stabilization—have emerged that weren’t apparent at the start of the year. Yet, despite these shifts, homebuyers remain cautious. The question now is whether potential interest rate cuts will be enough to motivate them to reenter the market, or if broader economic uncertainty will continue to hold them back. The fall market will be one to watch closely.

Michael Harris is Managing Director and Partner of the Servicing Practice at BlackFin Group. Michael has over 20 years’ senior executive management experience in default servicing and mortgage servicing. He and his team are subject matter in all aspects of servicing strategy, investor relations, process, compliance requirements. Prior to BlackFin, Michael was the President & CEO of Jennick Asset Management and was responsible for developing the pilot outsourced management program for Fannie Mae, Freddie Mac, and HUD while working with the top 10 mortgage servicing and capital markets firms. For more information contact info@blackfin-group.com